73 Alternative Protein Investments - 1H 2024

Latest Data & Insights on Alternative Protein Investments Globally

Hello,

My name is Nicholas Dahl, I am the Founder & CEO of Alternative Proteins Global (APG). In this Newsletter, I will be sharing detailed insights, databases, visualizations, reports & more across all aspects of the Alternative Protein Industry.

This Week: Investments

This week’s Newsletter will analyze Alternative Protein Investment trends for 1H 2024 & will provide insights into Alternative Protein Investment across these areas:

Investment Analysis

Technology - Plant-based, Fermentation & Cultivated

Product - Meat, Seafood, Dairy, Egg, Inputs & Ingredients

Geography - Continent (North America, Europe, Asia, Oceania, South America & Africa)

Largest Investments

Further Investment Information

Next Week’s Newsletter Topic: Investors

Investment Analysis 2023 - 1H 2024

Investment Deals:

32 Investment Deals in Q2 2024

41 Investment Deals in Q1 2024

73 Investment Deals in 1H 2024

144 Investment Deals in 2023

217 Investment Deals in 2023 - 1H 2024

Investment ($MUSD):

$398M USD Invested in Q2 2024

$333M USD Invested in Q1 2024

$731M USD Invested in 1H 2024

$1.51B USD Invested in 2023

$2.24B USD Invested in 2023 - 1H 2024

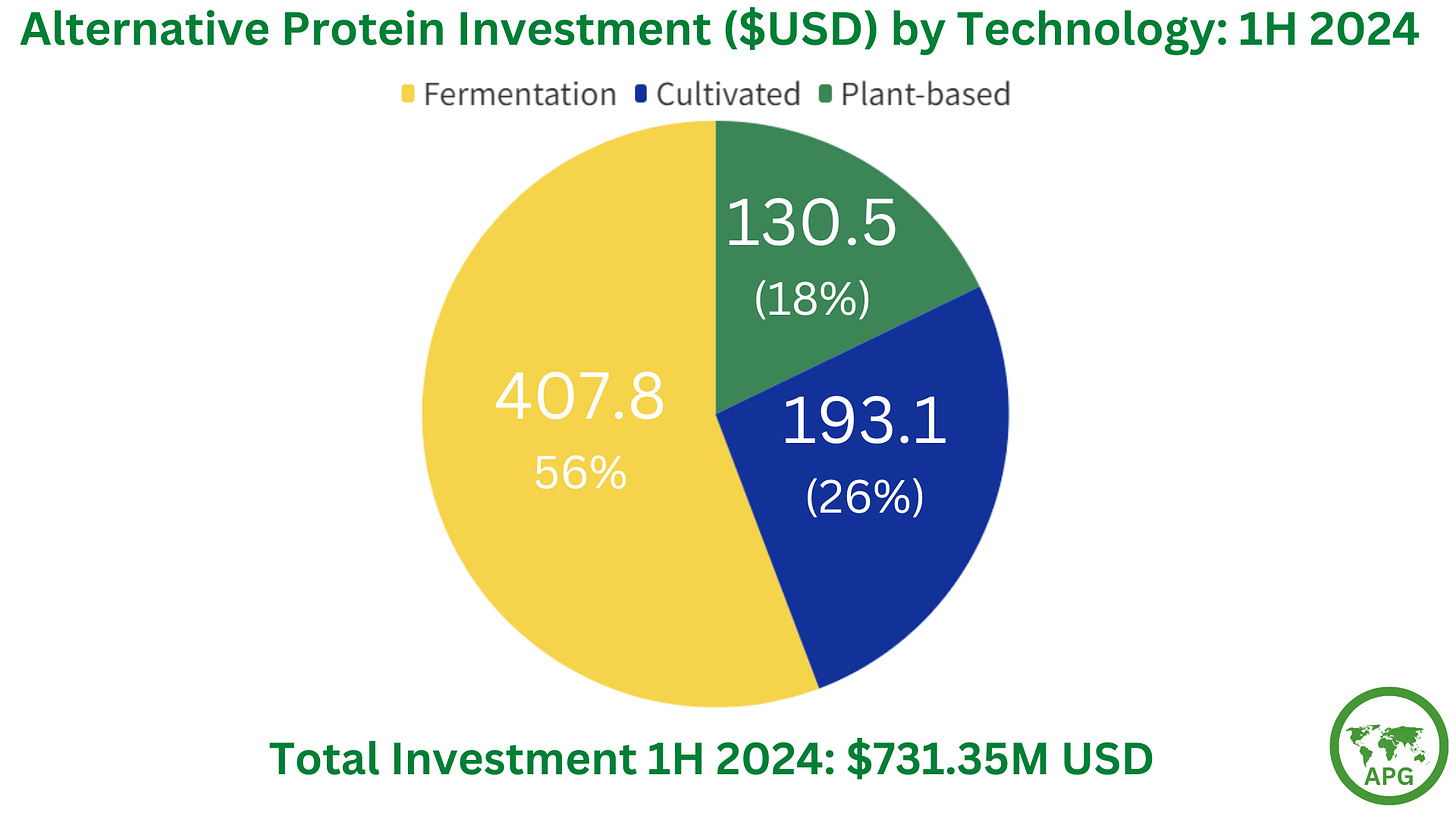

Investment by Technology

Investment by Technology 1H 2024:

Plant-based: $130.46M USD (18%) across 29 deals

Fermentation: $407.76M USD (56%) across 28 Deals

Cultivated: $193.13M USD (26%) across 16 Deals

Investment by Product

Investment by Product 1H 2024:

Meat: $444M USD (Largest Category - 61%) across 27 deals

Dairy: $113.7M USD across 12 Deals

Seafood: $3.8M USD across 3 Deals

Egg: $49.0M USD across 2 deals

Inputs: $28.6M USD across 7 Deals

Ingredients: $92.4M USD across 22 Deals

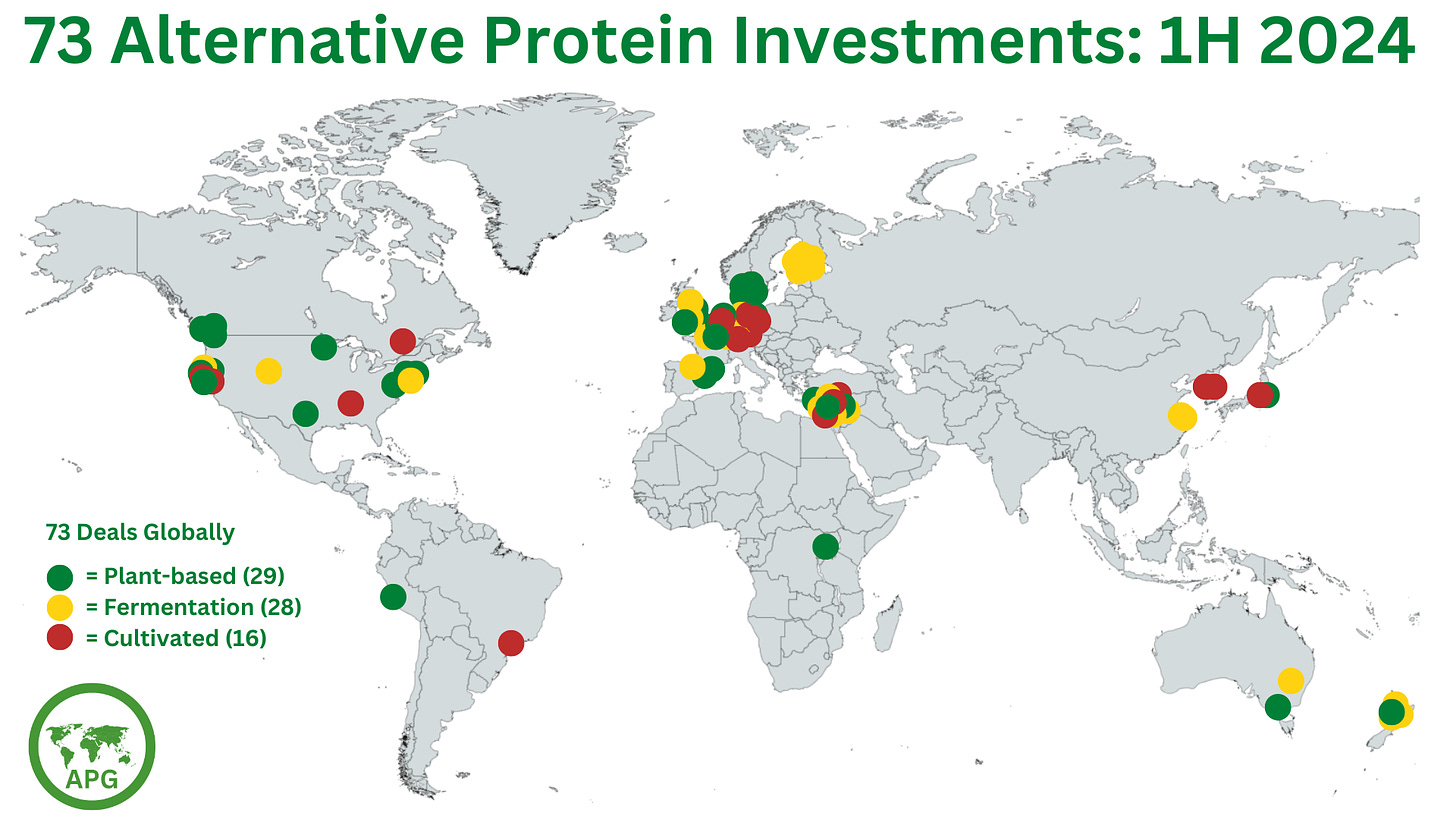

Geography of Investments

The Map below shows the location of Alternative Protein Investments Worldwide in 1H 2024.

Investment Deals by Continent (% of Global Deals) 1H 2024:

Europe - 41%

North America - 25%

Asia - 22%

Oceania - 8%

South America - 3%

Africa - 1%

The Northern Hemisphere accounts for 88% of Global Deals.

The Southern Hemisphere accounts for 12% of Global Deals.

Investment Amount by Continent (% of Global Investment) 1H 2024:

Europe - 47% (Largest Continent - $347M USD)

North America - 38%

Asia - 12%

Oceania - 2%

South America - 0%

Africa - 0%

The Northern Hemisphere accounts for 98% of Global Investment.

The Southern Hemisphere accounts for 2% of Global Investment.

Largest Investments: 1H 2024

3 Largest Alternative Protein Investments ($M USD) in Q2 2024:

Meati Foods - $100M USD - Series C-1 - Fermentation (Meat) - United States

Prolific Machines - $55M USD - Series B1 - Cultivated (Meat) - United States

Mosa Meat- $42.5M USD (40M Euros) - Series B - Cultivated (Meat) - Netherlands

These 3 largest investments account for 50% of alternative protein investment globally in Q2 2024.

5 Largest Alternative Protein Investments ($M USD) in 1H 2024:

Meati Foods - $100M USD - Series C-1 - Fermentation (Meat) - United States

Perfect Day - $90M USD - Pre-Series E - Fermentation (Dairy) - United States

Infinite Roots - $58M USD (53M Euros) - Series B - Fermentation (Meat) - Germany

Prolific Machines - $55M USD - Series B1 - Cultivated (Meat) - United States

Heura - $42.97M USD (40M Euros) - Series B -Plant-based (Meat) - Spain

These 5 investments account for 47% of alternative protein investment globally in 1H 2024.

Further Investment Information

All data & insights detailed in this Newsletter is sourced by Alternative Proteins Global. It includes all investments into alternative protein companies, excluding:

Accelerator & Incubator Cohorts

Investments not made into companies e.g. Government Projects, Universities

Investments that APG cannot independently verify

Investments made into companies whose main focus is not alternative proteins

Book an introductory meeting with me here if you need more detailed alternative protein investment data or insights.

Next Week: Investors

Next Week’s Newsletter Topic: Investors in the alternative protein industry globally in 1H 2024.